Are you curious about the second round of monies from the Paycheck Protection Program (PPP)? If you are, the application process has officially opened; however, it will close in March 2021, or when the money is gone; therefore, apply early.

Your Business Needs A 25% Decline In Gross Receipts.

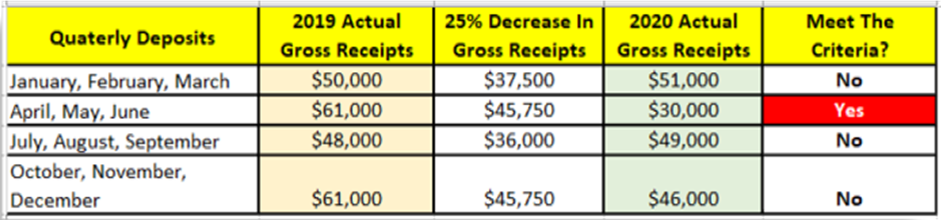

If you want to apply for the next PPP round, your business needs to have a 25% decline in gross receipts in any ONE quarter of 2020 as compared to the same quarter in 2019. The easiest way to check this is to look at the deposits on your bank statements or in your accounting software program, i.e., QuickBooks.

Sample Analysis Below:

- The PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP Loan with the same general loan terms as their First Draw PPP Loan.

- Second Draw PPP Loans can be used to help fund payroll costs, including benefits. Funds can also be used to pay for mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations.

Click Here To Download Your PPP Loan Application

Maximum Loan Amount And Increased Assistance For Accommodation And Food Services Businesses.

For most borrowers, the maximum loan amount of a Second Draw PPP Loan is 2.5x average monthly 2019 or 2020 payroll costs, up to $2 million. For borrowers in the Accommodation and Food Services sector (use NAICS 72 to confirm), the maximum loan amount for a Second Draw PPP Loan is 3.5x average monthly 2019 or 2020 payroll costs, up to $2 million.

Who May Qualify?

A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

- Previously received a First Draw PPP Loan and will or has used the full amount only for authorized uses.

- Has no more than 300 employees.

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

- Top-line Overview of Second Draw PPP Loans

- Frequently Asked Questions for Lenders and Borrowers (12-09-20)

- How to Calculate Loan Amounts

- Frequently Asked Questions for Faith-Based Organizations Participating in the PPP and Economic Injury Disaster Loan Program

- PPP Myth vs. Fact