This year, employers with over 50 employees are being asked, CORRECTION…. are being forced to provide their employees access to an account that helps them save for retirement. In 2018, the state of California became one of the growing number of states to approve and roll out its own state sponsored retirement plan now officially known as the Cal-Savers Retirement Savings Program (www.calsavers.com)

Starting in 2020, this mandatory program required California based employers to enroll their employees in the CalSavers program. Employers are required, UNLESS they establish their own company sponsored plan (401k, Profit Sharing, SEP, SIMPLE IRA) or certify that the company already sponsors its own retirement program.

But the enrollment or certification process has a deadline based on number of employees. The deadlines for enrollment or certification are as follows:

|

Size of Employer |

Deadline |

|

> 100 Employees |

June 30, 2020 (later Sept 30, 2020) Deadline passed, register today |

|

> 50 Employees |

June 30, 2021 |

|

5+ Employees |

June 30, 2022 |

The CalSavers program:

- Uses Roth (after tax) retirement accounts (IRAs) as savings vehicle.

- Has automatic enrollment with a default savings rate starting at 5 percent of gross pay (employees can opt out of or change their rate at any time)

- Unless changed by employee, contributions increase by 1% every year until maximum of 8% rate is reached.

- Offers account holders a choice of investment options including money-market, core bond, global equity, and target-date funds.

- Does not allow employer contributions.

The first task for interested employers is to register your company with CalSavers and upload an initial employee census. CalSavers then establishes account for each employee, notifies them of up-coming enrollment, and communicates directly with employees on an ongoing basis. The employers only ongoing responsibility includes maintaining updated employee data, withholding contributions from salaries, and remitting contributions to Cal Savers employee accounts.

As an experienced payroll provider, Rabco Payroll Services, Inc. can assist with the registration and with many of the ongoing responsibilities required from Cal Savers. Please email us at support@rabcopayroll.com or call rabco for more information at 626-479-2022.

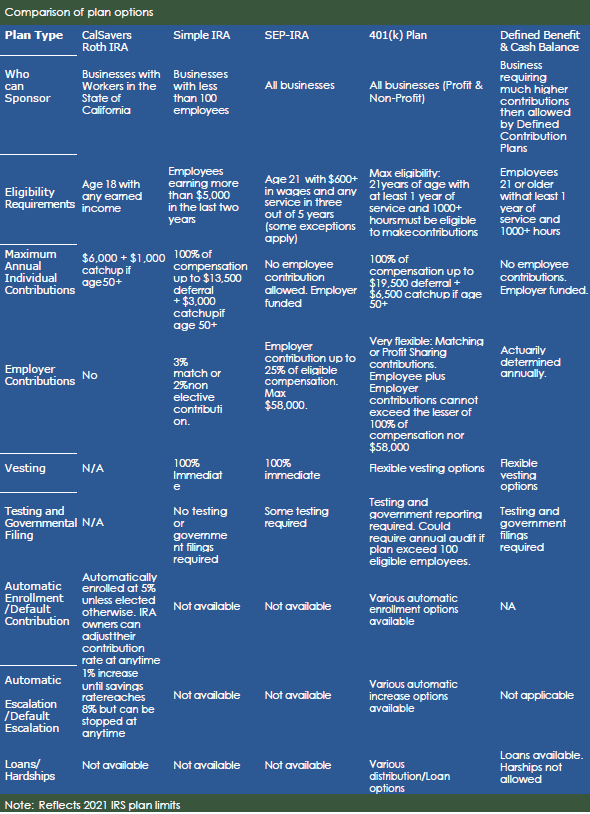

CalSavers is simple and low cost. But is it the right retirement vehicle for your company and workforce?

Depending on your company’s demographics and financial situation, CalSavers may be the right choice. However, could this be the year you consider sponsoring your own company sponsored plan and add it to your employee benefits package? CalSavers could be a good start but will it help you with organizational goals and to attract and retain employees?

An important reason for establishing a company 401(k) plan is to attract and retain quality talent for the company.

A company benefits package is among the foremost considerations of highly qualified talent when searching for a new position. Offering a 401(k) plan with an employer contribution can set a company apart from the competition and make exceptional candidates more likely to accept a job offer.

Other features and benefits of an employer sponsored plan that is not provided by Cal Savers include the following:

- Tax Savings – employer contributions (up to applicable limits) are tax-deductible.

- Higher contribution limits – plan participants can contribute up to $19,500 of their pre-tax income in 2021 (an additional $6,500 in catch-up contributions if age 50 years or older), giving business owners the opportunity to benefit from the same tax advantages as their employees.

- Start Up Tax Credit – a small business with fewer than 100 employees can claim a tax credit up to 50% of the cost associated with its new retirement plan for up to three tax years. The credit can range from $500 to $5,000 as an incentive for new start up plans.

- This is your plan! It is your ABC Company Inc 401k Plan, not the state of California’s plan. The plan is part of your benefits package that can be customized and changed over time to meet your organizational needs.

RABCO Payroll Inc has the experience and resources necessary to help you decide whether your own company sponsored plan makes sense or if you need to begin with CalSavers. You can always set up your own 401k Plan later. Either way, we can assist.

You may already sponsor your own 401k plan. We are happy to review your plan and provide a benchmarking report to help you determine optimal design and to help you evaluate investment quality, quality of service, and fee competitiveness.

From plan design, installation, and conversion of an existing 401k plan. We can help. Please email us at support@rabcopayroll.com to schedule a time to review your company’s situation. You can also reach us by phone at 626-479-2022 ask for Rob Rabichuk.